Scalable Brands

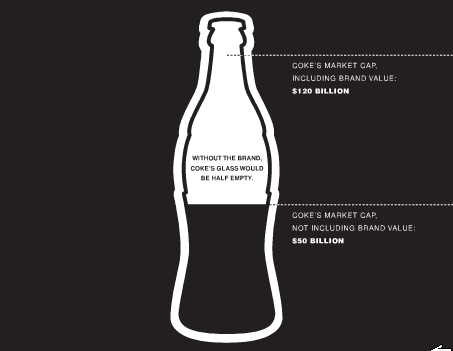

When I uploaded my Brand vs. Utility presentation to SlideShare last week one of the related slideshows, The Brand Gap caught my eye and I clicked on over. Within a few slides I had stumbled upon the image below, which really got my brain pumping.

Based on Interbrand's current brand value calculations (from 2007) Coca-Cola's brand is work $65.3 billion (down from $67 billion in 2006) while their market cap is $134 billion (as of 3/17/08). Subtract brand value from market cap and you're left with $68.7 billion, meaning that roughly half of the company's value is derived from their brand. (If you're interested, BusinessWeek has a bit more info on how Interbrand calculates value and for those interested, Millward Brown has their own rankings which most notably place Google first instead of 20th.)

To understand how this is possible, I think it's important to understand why brands exist (which luckily I ran across today on The Concise Encyclopedia of Economics). We all know more or less that it's a trust thing, but the article did a good job of adding a bit of nuance to the explanation. As it explains, brands exist because consumers have incomplete information and brands provide a way for consumers "to protect themselves without having to devote huge amounts of time to learning all the details about each company's product." By providing this value, brands are able to charge consumers more for their products. In return, what consumers receive is increased reliability as a brand's reputation increases. As clearly explained by the following two stories, the more valuable a brand becomes the less it can afford to screw up.

Consider, for example, the cost imposed upon Perrier in 1990 when it was discovered that the benzene used to clean its bottling machinery had contaminated some of its product. Perrier experienced a significant decrease in demand and had to spend large amounts of money on increased advertising, free samples, and other marketing and promotional expenditures in an attempt to recover its market share. Another recent newsworthy example was the image damage, lost sales, and greatly reduced profits suffered by Beech-Nut, the baby food company, when it was discovered in 1982 that its "apple juice" consisted of water, sugar, and flavoring. If brand names were not present in these cases, the large economic punishment imposed on the nonperforming companies would have been lost.

What's so interesting about brand value to me, though, is that it's scalable: Small investment can provide exponential returns (hat tip Nassim Nicholas Taleb on this definition). Invest a dollar in your brand and you might receive $100 back or you might receive $10,000, there's no direct correlation between investment and return (which is why Google can devote less than 10% of its revenue on sales and marketing while competitors devote 20-plus-percent (as I mentioned in my Brand vs. Utility presentation, however, defining marketing activities for a company like Google can be a bit problematic).

All of this got me thinking about two very different things: First, most advertising agencies are incredibly short-sighted in not investing in their brand. After all, their business is not a scalable one (to make more money you need to spend more time/hire more people), therefore it would make sense to spend on the one thing that is scalable: Their brand. The second thing I thought about was how this relates to direct vs. brand marketing (or more specifically how to answer the question "how much is this going to boost my sales"). Unfortunately I don't have some kind of holy grail answer, but clearly the opportunity to tap into exponential growth is what's at stake (something pay-per-click pretty much by definition can't deliver).

As usual, this is where I peter out . . . So I'll leave things here. I think some of what John Batelle is talking about (thanks for the link James) relates, but I don't have the energy to go into at the moment. Thoughts?